Hello all,

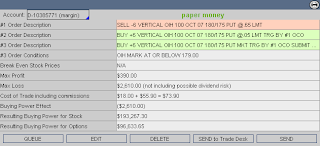

The figures show the result of the latest set of trades. With CAL rising we decided to buy back the short leg. We also opened a new spread on RUT. As currently we ahead by $912. Not bad, hun?

Brian

Here is the challenge: You have been awarded $100,000 (in your own paper trade account) You can get a new paper trade account at cboe.com http://www.cboe.com/tradtool/virtualtrade.aspx • Trade for one month (till we meet again) • Maintain your trading journal. • and at the next meeting present your trades • Stocks to trade only are: $RUT- Russell 2000 Index CAL – Continental Airlines OIH – Oil Service Holders Trust GS – Goldman Sachs Group

Happy Trading,

Brian

Hello Traders,

Hello Traders,